Media Centre

< Back to Media Centre Home

SelectingSuper Media Release - Wednesday 7 June 2017

| |

| SUPERANNUATION PERFORMANCE - April 2017

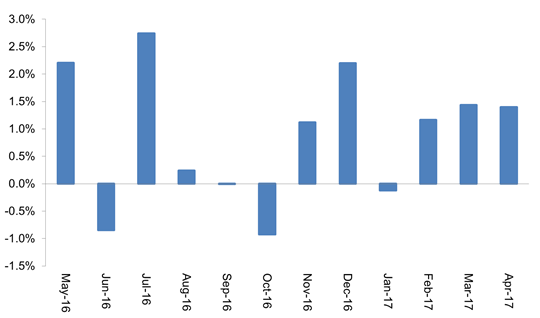

The SelectingSuper workplace default option MySuper Index increased by 1.4% in the month of April. The positive April result was underpinned by solid monthly returns in equities and property. This is the third consecutive month of above 1% monthly returns for the average workplace superannuation default fund.

|

| |

| SelectingSuper MySuper Index - Monthly Returns |

|

|

| |

| The monthly rise brings the 12 month annual return for April 2017 to a very strong 11.1%. Highlighting this strength, three quarters of all workplace default options achieved annual returns over 10%. Similarly over a three year period, 75% of workplace default options achieved annualised returns over 7%, a return in excess of CPI + 5%.

The performance over multi-year time periods continues to benefit from positive impact of the high returns since 2012. Reflecting this, three year rolling MySuper returns are 7.7% pa and five year returns are 9.4% pa. The longer term 10 year return is a more modest 4.7% pa, although this period incorporates the full effect of the GFC and is overlaid by a lower inflation environment.

|

|

| |

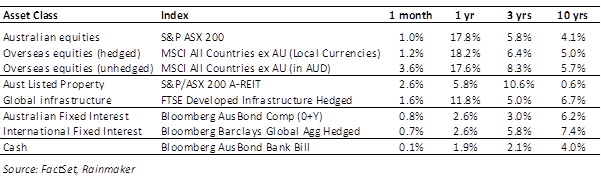

| On an annual basis Australian equities, often the largest asset class in many balanced funds, contributed with a very solid 17.8% return. Similarly the contribution of hedged international equities was 18.2% for the 12 months to April. The strengthening of the Australian dollar over the year resulted in a slightly lower 17.6% return for unhedged international equities.

The infrastructure index continues to reflect strong returns in that segment over the short term, and even exceeding equities over the medium term. Property, which has provided a significant positive impact on investment outcomes over recent years, has now dropped back to a more modest contribution of 5.8%.

The movement in the yield curve in late 2016 has resulted in annual fixed interest returns dropping back both domestically and internationally, however the market has somewhat stabilised and annual returns to April 2017 from fixed interest are positive for most funds.

In net terms this means growth orientated default options with relatively high exposure to equities, and infrastructure significantly outperformed in the 12 months to end April. Similarly funds with relatively larger holdings in fixed interest in the period underperformed.

|

| |

| Financial Market returns to April 2017 |

| |

|

|

| |

| Leading products: One year returns |

| The top 5 performing products in Workplace, Personal and Retirement markets over the 12 months to April 2017 are as follows: |

| |

| WORKPLACE SUPER (MYSUPER/DEFAULT) |

|

| LGS Accumulation Scheme - High Growth |

14.7% |

| Hostplus - Balanced |

14.2% |

| CFS FirstChoice Lifestage (1970-1974) |

14.1% |

| SA State Lump Sum Scheme - Growth |

13.5% |

| Telstra Super Corporate Plus - MySuper Growth |

13.3% |

| |

|

|

| IOOF Employer Super Personal - Profile 75 |

14.1% |

| MyLife MySuper Personal Plan - Moderately Aggressive |

13.5% |

| FirstState Super Personal - Growth |

12.5% |

| AustralianSuper Personal - Balanced |

12.4% |

| Kinetic Super Personal - Growth (MySuper) |

12.4% |

| |

|

|

| MyLife MyPension - Moderately Aggressive |

14.9% |

| Lutheran Super Pension - Balanced |

14.3% |

| Mercy Super Income Streams - Balanced Growth |

14.3% |

| Sunsuper Income Account - Balanced |

14.1% |

| Media Super Pension - Balanced |

14.0% |

|

| |

| Segment Performance |

|

Regarding the market segments, the gap between not-for-profit (NFP) funds and Retail funds within the Workplace sector continues. The 12 month return gap has, however, rose to 70 basis points in favour of NFP funds. The recent decrease in the annual gap reflects the relatively higher performance of Retail funds underpinned by strong returns in listed equity markets.

The long term 5 year segment gap is 130 basis points in favour of NFP funds.

|